The impact of localising council tax benefit

Changes to council tax benefits will affect poorer households and create inconsistencies in neighbouring areas. Multiple schemes will add complexity and reduce transparency.

The replacement of Council Tax Benefit (CTB) with Council Tax Support (CTS) marks a historic move from a nationally devised system to one of 326 different local schemes in England. This restructuring, along with a 10 per cent cut in funding, will create considerable challenges for local authorities, advice services and benefit recipients alike.

The study found that:

- In the year beginning April 2013, 18 per cent of councils will retain the 2012/13 levels of CTB and 71 per cent will require all working-age adults to pay at least some council tax, regardless of income. 11 per cent will make some changes but these will not affect all CTB recipients.

- Some 2.4 million low-income families will pay on average £138 more in council tax in the year 2013/14.

- 78 per cent of those affected by the changes currently pay no council tax. Councils will have to start collecting, on average, £140 per year from these households. It is unclear how economical this will be for councils.

- 2 million working-age CTB claimants are in poverty, and a further half million just above it. An increase in council tax would leave them with even less disposable income.

- The replacement of CTB with CTS marks a historic move to 326 different local schemes in England. It will be a curious system when a jobseeker with a state-provided income of £71.70 per week pays some council tax in some parts of the country, but is considered too poor to pay in others.

Summary

Key points

- CTB reduces the amount of council tax that low-income households have to pay, often to nothing. When a family's CTS is worth less than its CTB, it faces a tax increase.

- In the year beginning April 2013, 18 per cent of councils will retain the 2012/13 levels of CTB, 71 per cent will require all working-age adults to pay at least some council tax, regardless of income. 11 per cent will make some changes but these will not affect all CTB recipients. (Benefit to pensioners cannot be changed under CTS.)

- Some 2.4 million low-income families will pay on average £138 more in council tax in the year 2013/14. However, there is wide variation: the average tax increase ranges from £100 a year or less for 1 million recipients to £300 a year or more for 150,000 recipients.

- 78 per cent of those affected by the changes currently pay no council tax. Councils will have to start collecting, on average, £140 per year from these households (in monthly collections of just under £12). It is unclear how economical it will be for councils to pursue large numbers of low income families for these sums of money.

- 2 million working-age CTB claimants are in poverty, and a further half million just above it. An increase in council tax would leave them with even less disposable income.

- The replacement of CTB with CTS marks a historic move from a nationally devised system to one consisting of 326 different local schemes in England. It will be a curious system when a jobseeker with a state-provided income of £71.70 per week is considered to have enough money to pay some council tax in some parts of the country, but too poor to pay in others.

Background

Council tax benefit (CTB) reduces the amount of council tax that low-income households have to pay – often to nothing. As such, CTB is not a benefit, but rather a council tax rebate. In April 2013 the national system of CTB will be abolished and replaced with local systems of Council Tax Support (CTS).

The funding for CTS in 2013/14 will be 10 per cent less than CTB. In England, each of the 326 lower tier and unitary local authorities decides how the system will work in their area. The only requirement of central government is that the current levels of support for pensioners are retained. Under CTB, any unexpected increase in cost was met through the Treasury’s budget, but under CTS the Treasury’s spending is fixed, so the local authority is liable for any changes in cost. (Funding for CTS in Scotland and Wales will also be cut by 10 per cent but there will be no change for claimants. The Scottish and Welsh governments are making up the cut from other sources.) To complete this study, information was collected from each of the 326 English local authorities on their CTS schemes for the year beginning April 2013. It was then analysed to estimate the impact of each scheme on local claimants.

The variety of Council Tax Support schemes

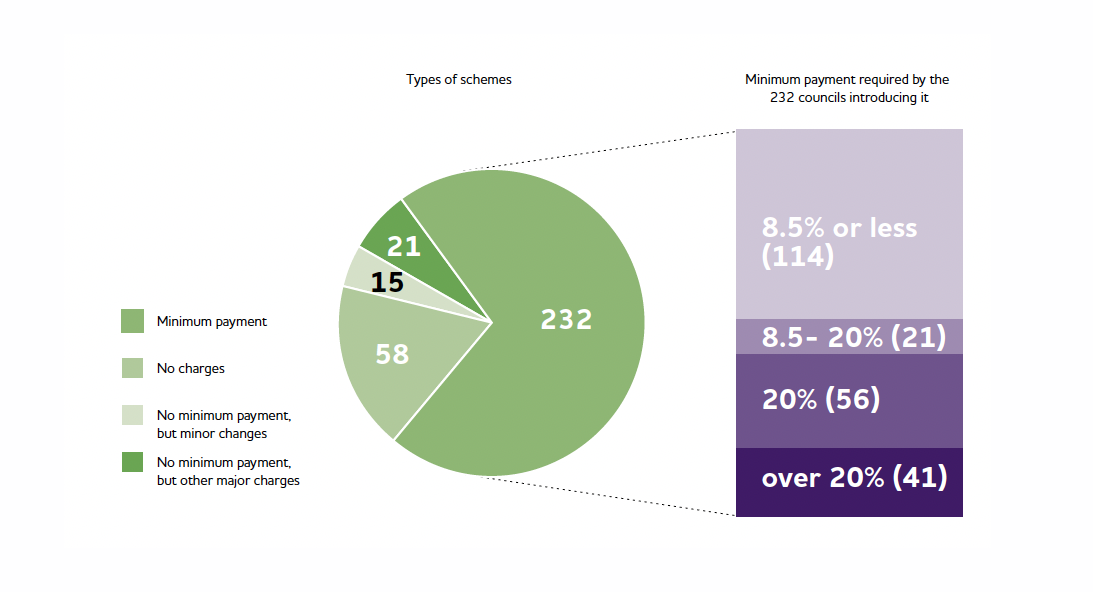

Figure 1 (see PDF summary) shows that 58 councils (18 per cent) will retain the current levels of support provided by CTB and will meet the funding shortfall by making savings or raising funds elsewhere. The most common change to existing CTB arrangements has been to require everyone to pay at least some council tax regardless of income: 232 schemes (71 per cent) include such a component. The remaining 36 (11 per cent) are making changes that will not affect all CTB recipients.

Types of schemes Minimum payment required by the 232 councils introducing it

In April 2013, 232 councils will require all households to pay at least some council tax, regardless of income.

But within this broad picture there is considerable variation in how councils in have adapted CTB into CTS schemes. In most areas CTB entitlement is being adapted in multiple ways – by changing, for example, the income taper, how income is calculated or introducing a band cap. As a result very few schemes are exactly alike.

The impact on claimants

The study estimates that of the 2.9 million working-age CTB recipients in England, 2.4 million will pay on average £138 more in council tax in the year 2013/14 (or an average of £132 for in-work recipients and £140 for those not working). However, there is wide variation. The reduction in support will depend primarily on which local authority someone lives in. But there is also variation within local authorities and the groups that are hit hardest will vary with the scheme design. Around 1 million recipients will have to pay less than £100 extra in council tax while some 150,000 recipients will have to pay at least £300 a year. A small number of individuals will pay much more than £300, as they are affected by multiple changes to the system.

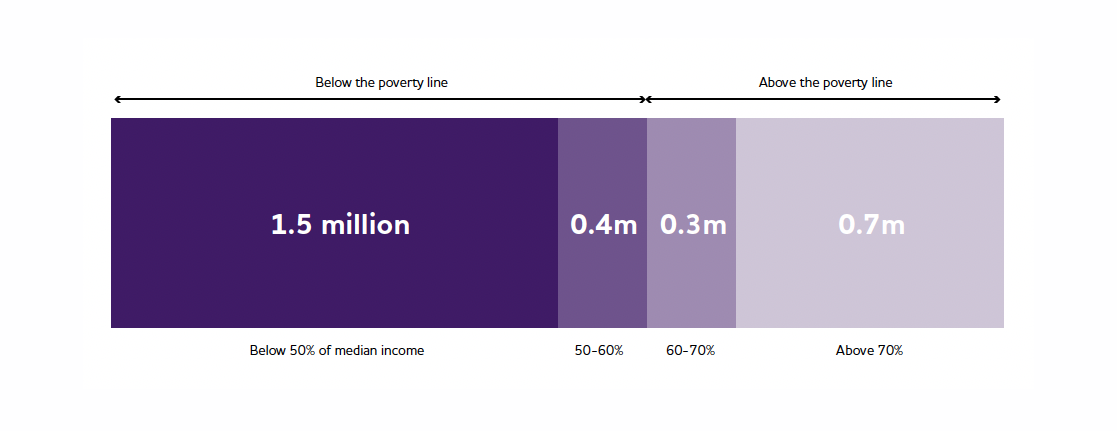

Figure 2 (see PDF summary) shows that 2 million working-age CTB claimants (65 per cent) are in poverty – and most of that is deep poverty. (Poverty is defined as being in a household with less than 60 per cent of the median income 'after housing costs'; deep poverty is less than 50 per cent of the median.) Of those claiming CTB who are above 70 per cent of the median income, over half are in receipt of a Disability Living Allowance (DLA). So whilst they are better off in terms of income, they also have a higher cost of living (which is why the DLA is paid out). An increase in the council tax these households have to pay will leave them with even less disposable income. Overall, 730,000 families claim both CTB and DLA. Some 78 per cent of the 2.4 million affected live in non-working households and currently pay no council tax. From April 2012 councils will collect on average £140 per year from these households, in monthly collections of just under £12.

2 million working-age families claiming CTB are already in poverty – and most are in deep poverty.

Conclusion

The replacement of CTB with CTS marks a historic move from a nationally devised system to one consisting of 326 different local schemes in England. This restructuring of the benefits system, together with a 10 per cent cut in funding, will create considerable challenges for local authorities, advice services and benefit recipients alike. In addition, these schemes are all liable to change again in 2014/15, as councils reflect on the first year and transitional grant funding expires.

The advantage of localism is that policies can be tailored to the needs of an area. A variety of different CTS schemes may help to determine the optimum combination of work incentives and protection of the poor. However, multiple schemes will add complexity and reduce transparency. Since 1948, entitlement to benefits has been determined by Parliament. However, under CTS there will be neighbouring areas where in one place a jobseeker will have an income of £67.10 per week after council tax, while across the road a jobseeker with an income of £71.70 can be deemed too poor to pay any council tax.

Cuts to means-tested benefits exclusively hit lower income households. When CTS is introduced most councils will start to collect a tax from families that they were previously deemed too poor to pay. With approximately 2 million working-age CTB claimants in poverty, and a further 300,000 just above it, an increase in council tax will invariably push more people into poverty or deeper into poverty. Furthermore, it is unclear how economical it will be for councils to pursue large numbers of low income families for limited sums of money.

This report is part of the social security topic.

Find out more about our work in this area.